ShopBack: Smarter Buying, Smarter Selling

Building a win-win-win experience in commerce.

How would you like some free money?

That’s what ShopBack is offering. It’s a discovery and rewards platform for shopping that helps consumers compare discounts across different merchants. Each time you use the app before making a purchase, you get up to 25% cashback on what you spent. All this, on top of your usual credit card rewards.

It’s little wonder that the app has soared in popularity. Since Henry Chan and Joel Leong founded it in 2014, ShopBack has expanded from Singapore to nine other countries, including Indonesia, Australia and South Korea. It now has more than 35 million users. And as of 2020, it has returned more than $100 million to users.

Investors have taken notice as well. In February this year, Asia Partners led ShopBack’s US$80 million Series F, bringing the total amount raised to US$230 million. Joining earlier investors such as January Capital, East Ventures, Credit Saison, and Singapore sovereign wealth fund Temasek, the round appears to be a stepping stone for ShopBack’s IPO bid.

All this progress is exciting, so it’s a shame that ShopBack has largely flown under the radar of SEA companies to watch. In this piece, we’ll take a look at the following:

Affiliate Marketing: The economics of modern-day advertising has been changed by a shift from a pay-per-view (CPM) model to a pay-per-sale model. This is what powers ShopBack and allows it to deliver value to merchants and consumers alike.

Product: Like many of SEA’s great companies, the idea for ShopBack wasn’t original. What made the difference was how its founders hyper-localised the idea and adapted it for the heterogeneous region.

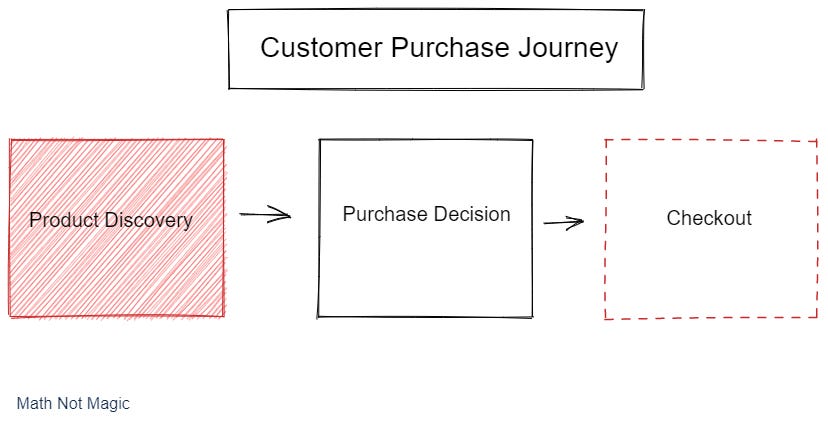

The Opportunity: ShopBack started as a discovery platform, but has slowly expanded into different stages of the customer’s purchase journey, especially with their new buy now pay later (BNPL) feature.

Future: ShopBack might still be small when compared to other e-commerce platforms, but there’s a chance they’re the dark horse that benefits the most from the rise of e-commerce in SEA.

Let’s get into it.

Affiliate Marketing 101

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” - John Wanamaker

To understand ShopBack, we first have to understand affiliate marketing.

For the longest time, if you wanted to advertise a product, you’d have to pay a fixed fee to the publisher for the ad placement. This was true no matter the medium. Whether it was Mad Men-styled ads in the classifieds section or a 30 second commercial after the 9pm news, advertisement inventory was valued and sold based on the size of the audience the publisher commanded. If consumers didn’t buy the product, there was nothing you could do about it.

Affiliate marketing flipped that model on its head.

Instead of paying for views, marketers realised that they could pay publishers a commission for driving sales instead. This leads to an alignment between the advertiser and publisher, where both are incentivised to make sure that the ad drives sales. In return for taking on this risk, publishers get a bigger slice of the pie than they would otherwise have if they took a fixed fee. It’s a win-win situation.

It sounds simple, but this had an enormous impact on the digital advertising landscape. Since businesses didn’t have to worry about ads flopping, they were happy for anyone to promote their product. Businesses jumped on this trend in the 1990s, and the first affiliate commission networks were borned. But the most significant affiliate program that would be created during this period was from a little known online bookstore - Amazon.

Just look at how many categories the program covers.

It’s why we have thousands of niche sites writing about “the top ten cameras to purchase in 2022” or “the most essential things you should have when you do XYZ”, all with affiliate links sprinkled within that point you to a product on Amazon. And it’s not just small-time creators who rely on affiliate revenue. Most media publications do so as well; The New York Times even has an entire newsletter that consists of nothing but product recommendations.

I go through all this to show that affiliate marketing has become a big thing. Most of this can be attributed to the win-win partnership between publishers and advertisers.

But what about consumers? Sometimes they get an honest recommendation from an expert in the field who’s making an affiliate commission as a bonus for their tips. That’s helpful. But other times it’s just spam, whether it’s from a generic listicle or an Instagram post from an account with barely over a thousand followers.

That’s where ShopBack comes in.

Building a Platform

Instead of selling products for its partners through content, ShopBack offers would-be purchasers a cut of the affiliate commission.

Whenever a user hops on ShopBack and decides to make a purchase, ShopBack directs him to the merchant’s site. If a purchase is made, ShopBack gets credited with driving the sale and earns a commission, much in the same way that affiliate marketers do. ShopBack takes a small cut, but the majority of that commission is then returned to the customer in the form of a cash back.

This is essentially affiliate marketing on steroids. Merchants are always on the lookout for new customer acquisition channels, and they’re happy to participate so long as customer acquisition costs (CAC) are lower than their lifetime value (LTV). With ShopBack, they can be sure that their margins are positive on every sale since they do payouts on a commission basis. It’s a no-brainer.

The value proposition is just as clear for consumers. Since ShopBack doesn’t make money through interchange fees, users can still choose their own mode of payment and earn the accompanying rewards. And when you can stack ShopBack’s cashback on top of your credit card rebates or airline miles, the question isn’t so much why you’d use it. It’s “why not?”

Origin Story

To be fair, ShopBack’s idea wasn’t original or unique. Lots of companies had operated with this model with a fair degree of success, although none of them were in Southeast Asia.

There was Ebates, the pioneer of the cashback model, which had been operating profitably in the United States before Rakuten acquired it in 2014 for a billion dollars. In China, there was Fanli, which reached unicorn status in 2015. And in the United Kingdom, upstarts such as Quidco and TopCashback have emerged and reached valuations of nine figures in just a couple of years.

Chan and Leong spotted this opportunity and their timing couldn’t have been better. E-commerce was starting to grow rapidly in the region; the duo witnessed this first-hand at Zalora, a Rocket Internet-backed company that aimed to be the Zappos of SEA. Indeed, the early 2010s would be a golden age for e-commerce marketplaces - regional giants such as Tokopedia, Bukalapak, Lazada, and Shopee would be founded then.

Market aside, the team and the idea were also compelling to investors. Leong recalls:

“I think there were two factors that convinced them to invest. The first was the team, which had e-commerce experience. At that time, there were not many e-commerce professionals in the market, and we were one of them.

The second was the fact that we weren’t jumping on some crazy bandwagon. We had a proven model that has worked in different markets for many years, and it was just a matter of time before somebody tried it in Southeast Asia. So we told them, “Either you bet on us or someone else is going to do it.””

Accel-X led their US$500K pre-seed round in April 2014, and this round was followed quickly by East Ventures less than a month later. With that money, Chan and Leong left their jobs to work on the idea full time, bringing four of their colleagues at Zalora with them to round off the founding team. Since then, they’ve been on a tear.

2015: Launched in Malaysia and Philippines

2016: Launched in Indonesia and Taiwan

2017: Launched in Thailand; announced US$25M raised total at Series C

2018: Launched in Australia

2019: Launch in Vietnam

2020: Closed US$75m extended Series D; Launched in Korea

2021: Closed US$40m Series E

2022: Closed US$80m Series F

A lot of this has happened quietly. When I dug into Crunchbase to check how much ShopBack had raised, I was surprised to find that a lot of information was either incorrect or incomplete. For example, you’ll see that there’s no mention of any Series C or D, and that CB thinks ShopBack had a US$14.4m seed round. And since Crunchbase gets its data from scraping the internet, we can tell that ShopBack spent most of its early years in full building mode, doing nothing but making a better product and signing up users.

That effort has paid off.

Between 2014 and 2017, ShopBack signed up more than 3.5 million users and 1,300 merchant partners. That grew to 19 million users and 2,500 merchants at the end of 2019, and to 35 million users and 10,000 merchants at the time of their latest fund raise. It’s little wonder that there’s strong investor interest.

The simple explanation for ShopBack’s growth is network effects. Each time a new user joins the platform, it makes more sense for a merchant to use ShopBack since they can reach more customers. And when more merchants join ShopBack, the platform becomes more valuable to users since it can be used at more retailers. That’s the beauty of two-sided marketplaces - once you get past the cold start, momentum will take care of the rest.

The Product

So what exactly does ShopBack do? The answer to this question has changed over the years.

When they first launched, their product was a simple webpage that highlighted the different merchants which offered cashback. All it did was highlight the highest cash rebates that a user could get and provide buttons that the user could click on to visit the merchant. The hope was that free money would be enticing enough.

ShopBack then launched its mobile app in 2016 on both Android and iOS. This caught on more quickly than expected. Within 24 hours of its launch , ShopBack’s iOS app became the most popular shopping app in Singapore. And as ShopBack expanded into new markets, its app evolved to meet the needs of each local market, from making sure that it appeared in the local language to showcasing the most popular shopping categories.

This proved to be one of the company’s inflection points. In Grab: One App To Rule Southeast Asia, I wrote that “any VC backed business which is based in SEA must win regionally, and not just in any one single market.” But because SEA is a heterogeneous region that comprises several countries, companies must grapple with different languages, cultures, business environments, and regulators.

ShopBack navigated that complexity with mobile. Although most consumers still preferred the web towards the late 2010s, it became clear from the growth numbers that mobile was the future in countries such as Taiwan and Australia. In fact, ShopBack faced resistance from incumbents in more mature markets, but was able to gain a beachhead because its competitors focused only on the web, but not their mobile app.

Of course it’s not as simple as going mobile first. Payments is a complicated space, and ShopBack had to localise its product for each market they were in. Would customers use bank transfers or credit cards to make in-app purchases? How would they receive their cashback? How much would they need to offer to entice new users, and would the economics work? Those were just some of the questions that ShopBack had to answer.

The team also didn’t stop building new features. In 2019 alone, ShopBack would launch:

ShopBack Button - a browser extension that automatically applies discount codes for users when checking out on a merchant site

Product Comparison - a feature that allows a user to search for a product within the app and compare prices between different merchants

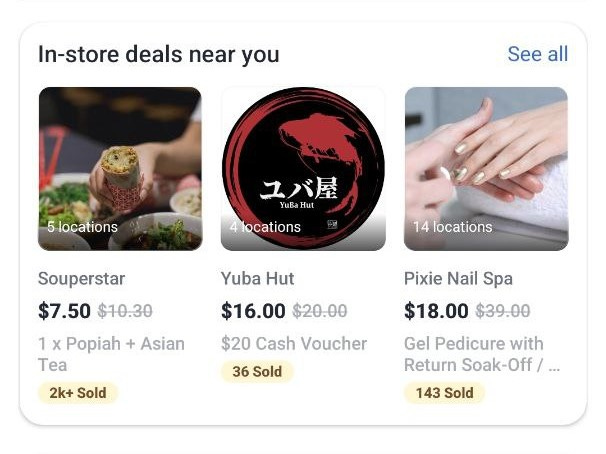

In-Store - a product that enables users to earn cashback even when they make physical purchases in offline locations

That last one is significant.

By expanding cashback to the offline space, ShopBack effectively opened up new verticals that were previously closed off to its business. Getting things delivered to your doorstep is nice, but there are certain things that you need to get out of your house to do for the best experience. Dining sits right on top of that list, but there’s also beauty and entertainment, all of which meaningfully expand ShopBack’s TAM.

It’s not just consumers and ShopBack who benefit; merchants derive value from this too. Through In-Store, traditional brick and mortar stores are able to get themselves in front of more eyeballs. In fact, ShopBack offers merchants the ability to sell their own vouchers on the app - at a discount - thereby providing an additional customer acquisition channel.

This might not sound like much, but the whole suite of services solves a lot of problems for offline businesses who want to go online. If you look at the journey of how a customer might buy a voucher and use it in a store, ShopBack is effectively handling marketing, payments, and a rewards program for the merchant. It’s the perfect solution for business owners who want a digital presence but not a full fledged online store.

ShopBack’s Next Act

As it turns out, providing such solutions to merchants is the big opportunity for ShopBack.

While ShopBack might have started as just a new customer acquisition channel for merchants, its cashback program has become the perfect wedge for it to layer on more services. From marketing to payments to inventory management, ShopBack is in the perfect position to become the all-in-one solution that can replace all the other vendors that merchants use. Think Shopify, but for both online and offline commerce.

Already, ShopBack has made significant progress. In January this year, it launched ShopBack Pay, its own mobile wallet that allows users to make QR code payments while still earning cashback. Last month, ShopBack rolled out ShopBack PayLater, its buy now pay later (BNPL) product that is available at over 4,000 online and offline merchants. The result is clear - ShopBack is entrenching itself in another part of the customer journey.

None of this should be surprising. Payments is a low margin, high volume business, which makes it the perfect vertical for ShopBack to expand into since its core competency lies in grabbing eyeballs and driving traffic. It’s good business sense, but crucially, also adds tremendous value to both consumers and merchants.

Take PayLater. Different BNPL providers have different models, but they essentially increase sales for merchants by making it more likely for consumers to purchase products by lowering the upfront cost. When the purchase is made, the BNPL provider underwrites that transaction and pays the entire sum to the merchant, less a percentage of the transaction, which they keep as a fee. And for consumers, they not only get to avoid paying the ridiculous fees charged by credit cards for late payments, but also effectively get a three month interest free loan. It’s a win for all parties.

Lots of companies talk about putting their users first, but few actually do it. In ShopBack’s case however, entering the payments space actually enhances the customer buying experience, and also helps the merchants whom they actually serve. To say that they’ve done so out of altruism goes too far - after all, they do need to make profits - but what’s clear is that ShopBack has created a lot more value than what they’ve captured.

Competition

So, where does ShopBack go from here?

On one hand, they’ve become the undisputed leaders in product discovery, and it’s safe to say that their affiliate marketing model has worked. Given the recent fundraise, ShopBack also has the war chest to scale up their marketing efforts and capture new markets on top of the ones they’re already in.

On the other hand, the road ahead is tough. BNPL is a huge opportunity, and existing BNPL providers know that. Beyond getting retailers to offer them as a payment method, they have also begun working on the consumer front, making BNPL the default method of purchase. In The Checkout as a Territory, Mario Gabrielle writes:

“How do you win the checkout? Increasingly, the answer is to move upstream. BNPL companies are engaging in a range of tactics to ensure that customers have already made their selection when it comes time to pay.

The primary method BNPL companies use is to make their site a destination in and of itself. The positioning of Affirm, Afterpay, Klarna, Quadpay, and Sezzle, per their websites, is remarkably similar. They present as a shopping website, allowing customers to browse by category before redirecting to a merchant page. Whether they realize it or not, the consumer has selected their method of purchase. When it comes time to pay, the site defaults to offering the BNPL provider-in-question.”

Does this sound like someone we know? You bet.

While ShopBack has gone downstream with payments, BNPL providers have gone the other way, putting the two in direct conflict with each other. Although BNPL providers don’t generate revenues with affiliate marketing, the fact that they’re becoming a shopping destination threatens ShopBack’s core business, even without accounting for payments. Already, we see this with Atome, one of the region’s fastest growing BNPL providers.

Then, there’s Grab. By entering financial services, ShopBack is competing with GrabPay and Grab Paylater, the super app’s mobile wallet and BNPL solution respectively. This is obvious; consumer focused payment solutions tend to be industry agnostic, and the two solutions are interchangeable to consumers. All it comes down to is who offers better terms and rewards.

But there’s still the merchant side. Grab offers loans and cash advances to its merchant partners, and it is here on the business solutions front that ShopBack and Grab could come into conflict. Through its BNPL offering, ShopBack will gradually gain competency in underwriting loans, and it’s not a stretch to imagine that they will eventually offer financing solutions to merchants as well. That’s just one example - there are just as many opportunities with inventory management, supply chain, advertising, and other areas that I’m not smart enough to come up with.

Future

In many ways, you can argue that ShopBack is an index on commerce in SEA.

ShopBack facilitates consumer spending by driving sales to merchants; in turn, it takes a percentage of the transaction as a commission. It then takes another small amount when the user transacts using its mobile wallet or BNPL solution. But for all of that to happen, a transaction needs to be completed, and ShopBack’s best bet is to make sure that the user gets the right product at the best price possible.

Sure, users could skip the product discovery phase and use ShopBack solely for its BNPL solution. But given ShopBack’s origins, this is unlikely to happen. If you’re using ShopBack at all, you’re probably drawn in by its cashback product. This creates an alignment between a platform and its users and merchants that you rarely see, and the result is that everyone who uses ShopBack benefits. Win-win-win.

Businesses are supposed to make money by creating value for others, but unfortunately, this doesn’t usually happen. ShopBack, however, is the rare exception.

When you see a company like that, you want to root for them. I certainly do.

Liked This Post?

Thanks for reading! If you liked this, subscribe to get posts sent directly to your inbox the moment it’s published.

And if you really love it, share this with someone else. It’ll make my day.

Thanks to Trevor and Yohanes for reading drafts of this.